Swiss National Bank Stands Firm Against Bitcoin Reserves After Rejecting Calls

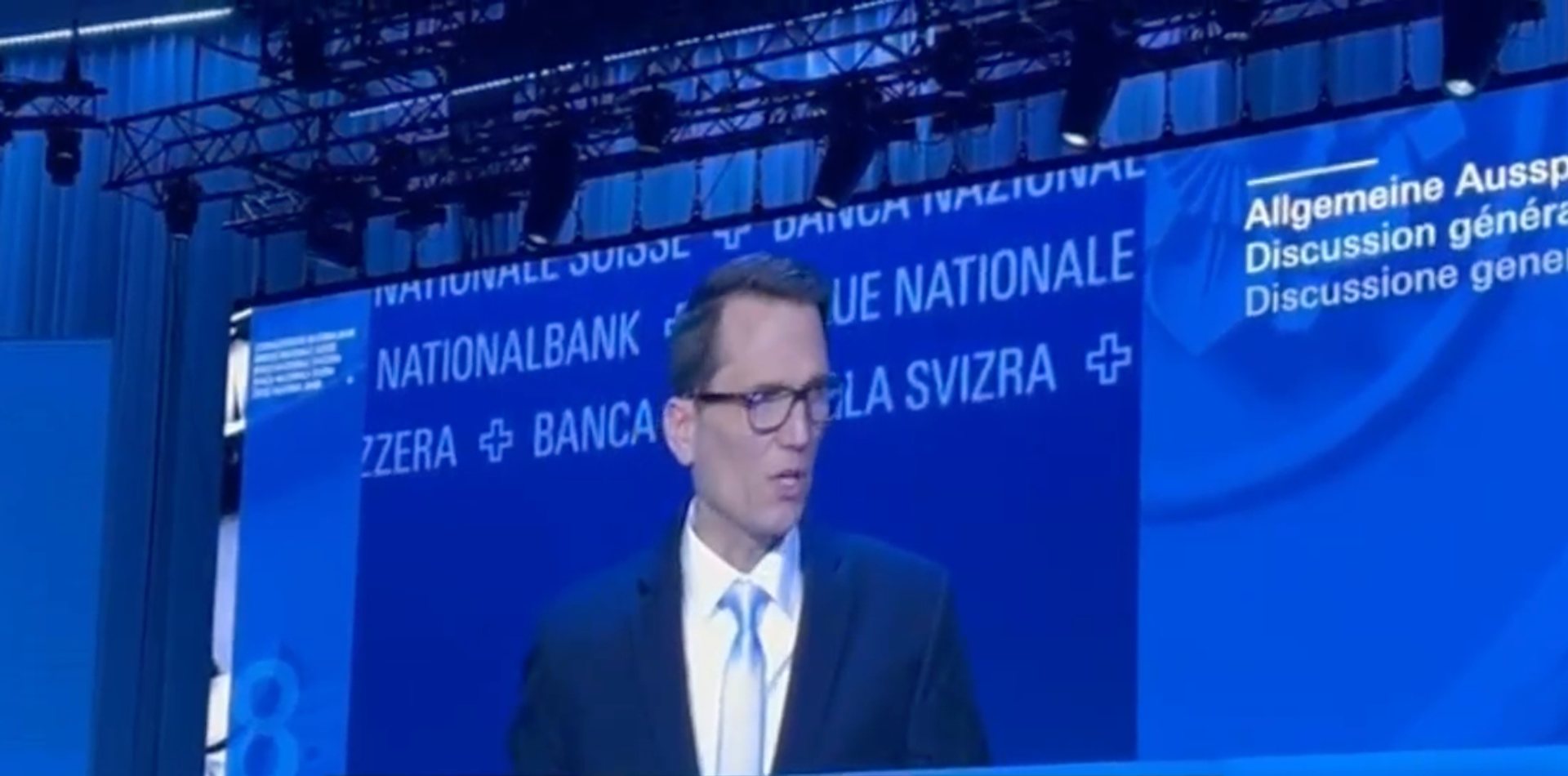

In comments Friday, SNB President Martin Schlegel said holding bitcoin raises liquidity and volatility risks for Switzerland.

The Swiss National Bank (SNB) has made a decisive stance against the addition of Bitcoin reserves amidst growing calls to diversify assets. SNB President Martin Schlegel emphasized the potential liquidity and volatility risks associated with holding the cryptocurrency, highlighting concerns for Switzerland's financial stability.

Schlegel's remarks came during discussions on Friday, underscoring the SNB's conservative approach towards embracing digital currencies in its monetary reserves. The rejection of Bitcoin reserves reflects the central bank's cautious attitude in safeguarding the country's financial interests against the backdrop of evolving market dynamics.

While some proponents advocate for integrating Bitcoin into national reserves as a hedge against economic uncertainties, the SNB remains resolute in maintaining a traditional and risk-averse investment strategy. The decision underscores the ongoing debate surrounding the role of cryptocurrencies in mainstream financial institutions and their compatibility with established monetary policies.