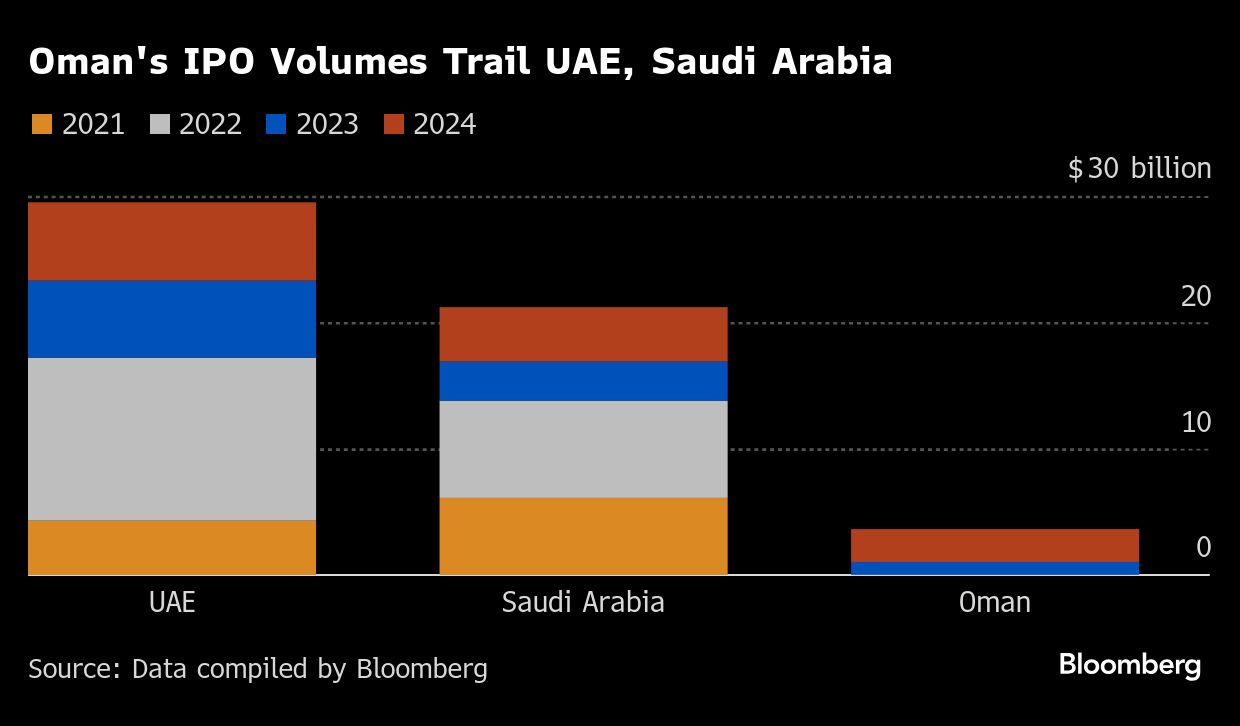

Oman’s IPO Pipeline Faces Crucial Test Following Record $2.5 Billion Haul

Muscat, Oman - Oman's IPO market is set to undergo a critical examination as companies feeling the momentum from a massive $2.5 billion windfall assess market conditions and investor appetite.

In the wake of a landmark $2.5 billion fundraising spree, Oman's IPO pipeline stands at a crossroads, facing a significant test of resilience and investor interest.

Major players in the Oman market, energized by the recent capital influx, are now closely monitoring market dynamics, seeking to gauge whether the appetite for new offerings remains strong.

The surge in IPO activity has been instrumental in bolstering Oman's financial landscape, injecting fresh capital and introducing new opportunities for investors looking to diversify their portfolios.

Industry experts speculate that the coming months will be crucial in determining the sustainability and growth potential of Oman's IPO market in the aftermath of the unprecedented fundraising success.

Despite the uncertainty surrounding global market trends, stakeholders in Oman remain optimistic, viewing the current juncture as a pivotal moment to solidify the country's position as a thriving hub for investment and economic development.